Transactional Liability Insurance

Transactional liability insurance (“TLI”) helps to protect buyers and sellers from the risks associated with M&A transactions and has become an important tool for deal facilitation.

Transactional liability insurance (“TLI”) helps to protect buyers and sellers from the risks associated with M&A transactions and has become an important tool for deal facilitation.

Premium rates in the cyber insurance market are stabilising, but are still unpredictable

This article provides an update on market conditions and some significant emerging cyber risks

Business instability and the possibility of unpaid debts is a persistent challenge that undermines growth prospects, investment plans, and the ease of transactions essential for success

Credit insurance provides a valuable solution to this issue, providing certainty in an uncertain environment.

Article explaining why the current difficult economic environment and changing working practices are driving increased commercial and employment litigation, making Commercial Legal Expenses insurance cover more vital for businesses than ever.

The collapse of Silicon Valley has direct implications within the insurance industry

Karen Allen Managing Director of GRP’s London Market broker Lonmar examines the impact of the SVB collapse the insurance market, and the exposure of company Directors to personal claims following an insolvency.

Article describing how inflation is affecting the cost of insurance

Insurance Market Overview 2023

A GRP blog giving you the latest insight and thought leadership from around the sectors

Building cost inflation makes it even more important to review buildings sums insured

Article outlining some key cyber risks to be aware of, and how to spot them

An update on the UK Construction insurance market in 2022

This article looks at the risks caused by the current hot weather and suggests some common sense measures to mitigate these risks

Article outlining why senior leaders are increasingly being held personally accountable for organisational issues and problems (eg cyber-attacks, environmental incidents and financial failings).

verview oents made to the Highway code with effect from 31st January 2022

GRP has won the Insurance Times Commercial Lines Broker of the Year Award.

This article describes the increasing need for business legal expenses insurance post pandemic

The difficult Professional Indemnity market, and how PI insurance buyers can get the best solution

This article outlines why the property insurance market has continued to harden in 2021, and provides tips on how property owners can get the best insurance deal

The Covid emergency has been the catalyst for rapid change and innovation in business practices

As we start to see a light at the end of the tunnel with a return to less restricted working, now is the time to think about how what has been leaned over the last year, and how this can make a positive difference to your business effectiveness in the future.

Remote working means cybercriminals can attack business systems by hacking staff’s personal devices

The lockdown has triggered a 53% increase in hacking, find out why

IMPORTANT COVID 19 CLAIM NEWS: Friday 15th January The Supreme Court upheld the judgement on the Financial Conduct Authority’s business interruption test case.

"Directors and Officers" "Management Liability" Insurance cover for "Property Owners"

BIBA BRIEFING ON TRAVEL TO THE EUROPEAN UNION FOLLOWING BREXIT

The recent revision includes a number of changes which provide added protection to hauliers. This article summarises the changes, and outlines why this is important from an insurance perspective.

The insurance market is hardening, bringing pressure from insurers to increase premiums, tighten terms and reduce coverage

This Briefing note reviews current market conditions, and provides guidance on how to work with your broker to manage the hard market.

The Coronavirus lockdown has created a high risk environment with increased likelihood of legal action against Directors and officers relating to breaches of Health and Safety regulations and employment law

Best practice advice on how to lay your vehicles up, store them and then bring them back in to operation

As the COVID-19 pandemic changes the way businesses in the UK function, this practical guide provides advice for SMEs on how to best manage the crisis

Cyber hackers’ phishing campaigns exploit the Coronavirus’s global panic.

Personal cyber insurance article with cyber risk management suggestions

GRP Group Transport and Logistics Practice Leader Tony Gardiner explains the importance of the C.M.R convention from an insurance perspective, and provides an overview of its main terms.

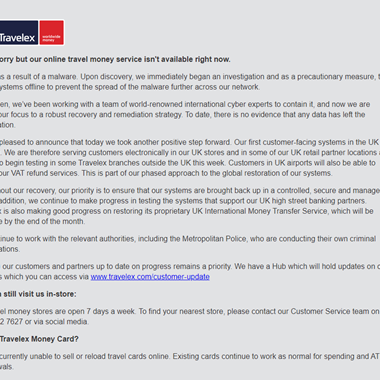

Hackers have held Travelex to ransom since the attack on New Year’s Eve, demanding the firm pay $6m (£4.6m) before they unlock its systems

The on Travelex has been nothing short of a disaster, and has been described by some media commentators as “a masterclass in what not to do”

GRP National Care Sector Practice Leader John Whittlestone explains why care providers face direct conflict between the rights of their employees and the rights of the people they care for

Recognising this issue, and having appropriate cover in place can help care providers to do the right thing by both employees and clients.

In order to ensure a successful motor trade business, it’s clearly vital to maintain and protect your most important assets — your vehicles

Debbie Airey GRP Group National Practice Leader for the Agricultural sector explains why a management liability cover should be considered as part of every farmer’s insurance programme

A physical copy of a Green Card on green paper is needed when travelling as digital copies are not currently accepted

If you arrive at the border without a physical Green Card, you will not be allowed to drive in that country.

GDPR has introduced severe penalties for companies which do not report breaches in 72 hours

Cyber insurance can help ensure an effective response.

Allianz estimate that inflationary factors have more than doubled liability claims costs over the last 10 years.

Group companies can now offer customers in the charity sector exclusive additional covers.

Allianz give their thoughts on key risks that could be caused by projects collapsing as a result of Brexit

Finding a broker with the right expertise is important to ensure that you have the right cover in the event of an abuse accusation

ICO fines cut deep, can Cyber Liability policies solve the problem?